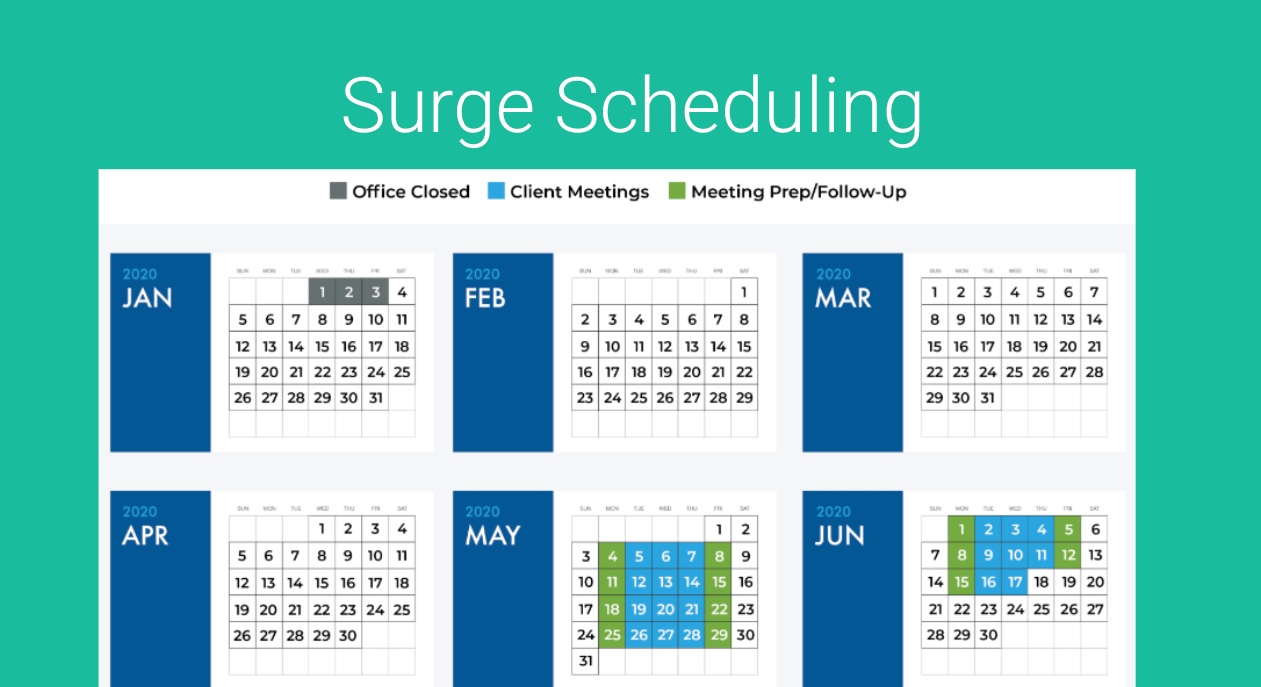

Surge Scheduling is now often a common practice in Wealth Management where financial advisors concentrate client meetings into specific, intensive periods—typically a few weeks or months each year—rather than spreading them evenly throughout the year. These “surge” periods involve back-to-back client review meetings, often 3–6 per day, several days a week, to maximize efficiency. The goal is to free up significant portions of the year for other critical tasks like business development, financial planning, continuing education, or personal time.

Benefits of Surge Scheduling

Time Efficiency

By clustering meetings, advisors can free up 50–75% of their year. For example, 100 client meetings at 4 per day could be completed in 25 days (5–6 weeks), leaving 30+ weeks for other priorities.

Increased Productivity

Focused meeting blocks reduce context-switching, allowing advisors to batch administrative tasks and dedicate uninterrupted time to strategic work.

Improved Client Experience

Structured scheduling can enhance preparation and consistency, delivering high-touch service during meetings. Clients often appreciate the flexibility to choose times within surge windows.

Work-Life Balance

Support reduced work hours (e.g., from 40–45 to 25 hours per week) while maintaining or growing revenue, allowing more family or personal time.

How GReminders can help

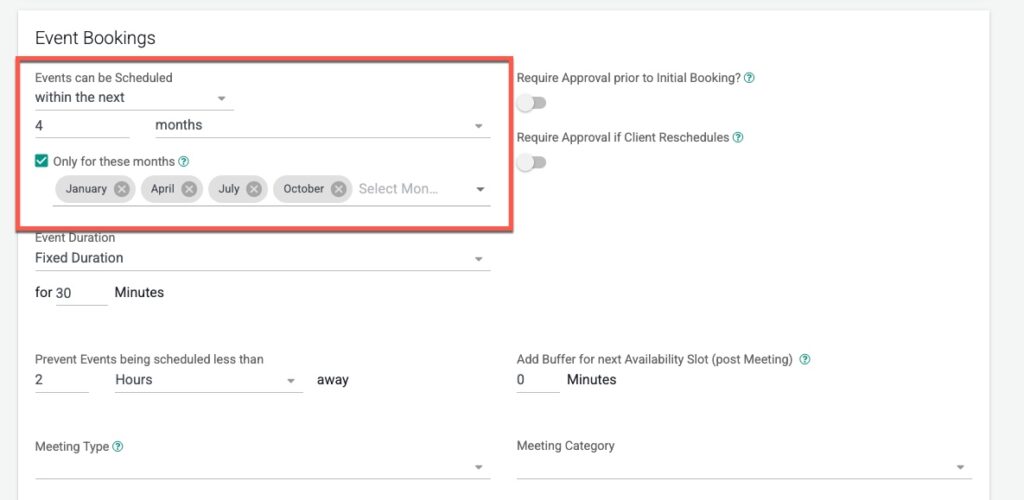

Within Event Types you can specify which “Months” clients can schedule meetings.

A typical configuration would be to allow clients to schedule in the next 3-6 months but ONLY for the first month of every calendar quarter. Example below:

If you do this at the Event Type Level (for Annual Review for example) you can easily roll this out via Managed Event Types.

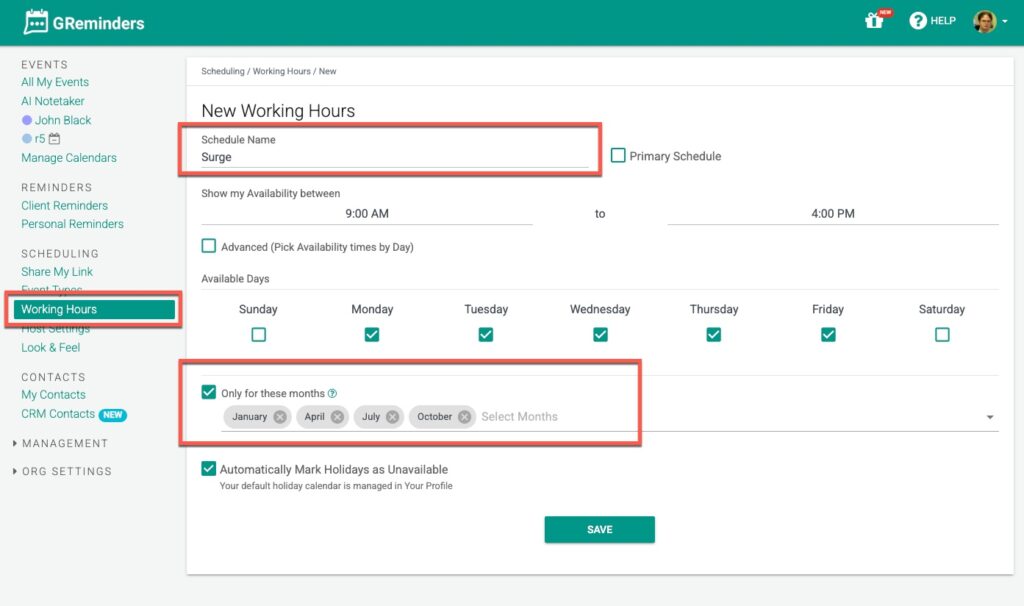

Additionally if each of your Advisors has a different “Surge” schedule OR some advisors do “Surge” vs other who do not, you can leave it up to each Advisor and they can manage this with an additional Working Hours Schedule, and then USE this Working Hours Schedule in their Annual Review Event Types like so:

Simple as that.

Surge scheduling in wealth management is a game-changer for advisors seeking efficiency and balance. By concentrating client meetings into intensive, well-planned periods, advisors can free up months for business growth, personal time, or deeper client work. While it boosts productivity and streamlines operations, success hinges on client buy-in and robust systems. For firms ready to embrace this disciplined approach, surge scheduling offers a path to work smarter, not harder, delivering value to both advisors and clients.

Any questions? Reach out to [email protected]

Happy Scheduling